The Online-Casinos.com News in 2025

Welcome to the news hub of Online-Casinos.com. Here we cover all the latest developments concerning online gambling. Our news team will bring you current updates about legislation, casinos, sports, poker, as well as expert analysis and fun trivia from across the gambling industry.

Gibraltar minister expresses concerns about UK gambling tax rises and the potential effects on Gibraltar. Key Facts: UK gambling tax increases could affect Gibraltar’s public finances A minister has urged the Gibraltar parliament to do things differently There are concerns that tax rises could undo work on corporate tax reform...

Hammerstorm from Pragmatic Play, releasing on 11 December 2025, is a high volatility 5×3 Viking...

The gang returns for another heist with Iron Bank 2 by Relax Gaming. Releasing on...

Hacksaw Gaming has unveiled its latest slot game, with UK online casino sites set to...

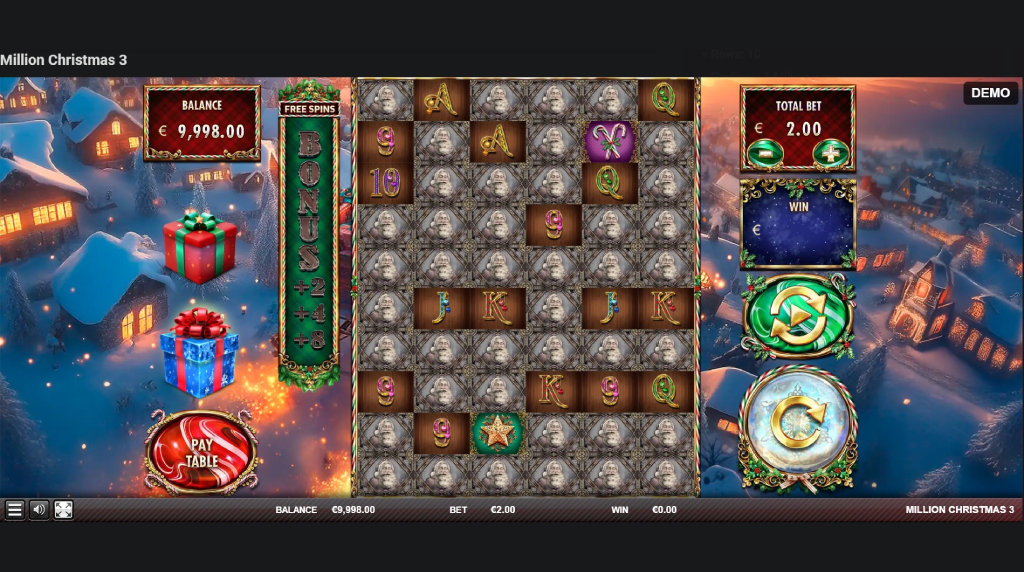

Get in the spirit of Christmas with Red Rake Gaming’s Million Christmas 3 coming out...

Savannah Fortune is a new online slot from Quickspin that’s set in the vast, open...

A pair of individuals who won $1 million in an Australian casino have been found...

Formula 1’s 2025 World Drivers’ Championship is set to go down to the wire in...

The government’s move to increase gambling taxes to raise over £1 billion for the public...

Crack open multipliers with Big Stack Nutcrack by Print Studios. Releasing on December 9th, this...

The 2026 World Darts Championship requires one player to win seven successive matches. Luke Littler...

Unpack wild presents in Santa’s Secret Party by TriggerButton. Releasing on the 5th of December,...

Jinx Gaming, one of Hacksaw Gaming’s newest partners, releases Dead Headz slot on 2 December...

Warnings About Tax Rise Consequences on Gibraltar Gambling

Warnings About Tax Rise Consequences on Gibraltar Gambling

Hammerstorm Slot Review – Lightning Respins Up to 10,000x

Hammerstorm Slot Review – Lightning Respins Up to 10,000x

Relax Gaming is Releasing Iron Bank 2 on the 10th of December

Relax Gaming is Releasing Iron Bank 2 on the 10th of December

Hacksaw Set to Release Jaws of Justice New Slot

Hacksaw Set to Release Jaws of Justice New Slot

Red Rake Gaming Releases Million Christmas 3 on 04/12/2025

Red Rake Gaming Releases Million Christmas 3 on 04/12/2025

Play the New Savannah Fortune Slot from Quickspin on 11 December

Play the New Savannah Fortune Slot from Quickspin on 11 December

Sydney’s Crown Casino Catches $1M Hidden Camera Scammers

Sydney’s Crown Casino Catches $1M Hidden Camera Scammers

Lando Norris Is Priced 1/3 to Win F1 Championship in Abu Dhabi

Lando Norris Is Priced 1/3 to Win F1 Championship in Abu Dhabi

‘Bad For Jobs’ – BGC Hits Out at Gambling Tax Rises

‘Bad For Jobs’ – BGC Hits Out at Gambling Tax Rises

Print Studios Releases Big Stack Nutcrack on December 9th

Print Studios Releases Big Stack Nutcrack on December 9th

Only the Stats Can Derail Luke Littler in World Darts Champs?

Only the Stats Can Derail Luke Littler in World Darts Champs?

TriggerButton Releases Santa’s Secret Party on the 5th of December

TriggerButton Releases Santa’s Secret Party on the 5th of December

Jinx Gaming Releases Dead Headz on 02/12/2025

Jinx Gaming Releases Dead Headz on 02/12/2025