The Online-Casinos.com News in 2025

Welcome to the news hub of Online-Casinos.com. Here we cover all the latest developments concerning online gambling. Our news team will bring you current updates about legislation, casinos, sports, poker, as well as expert analysis and fun trivia from across the gambling industry.

Strictly Come Dancing will be back on our TV screens in late September. Ellie Goldstein is the celebrity contestant bookmakers believe is most likely to lift the Glitterball Trophy. Key Facts: Fourteen celebrity contestants for Strictly Come Dancing's 23rd series have been announced. The bookmaker's early favourite is 23-year-old trailblazing Down...

Bockos is back for more Irish Greyhound Derby glory, but the history books suggest the...

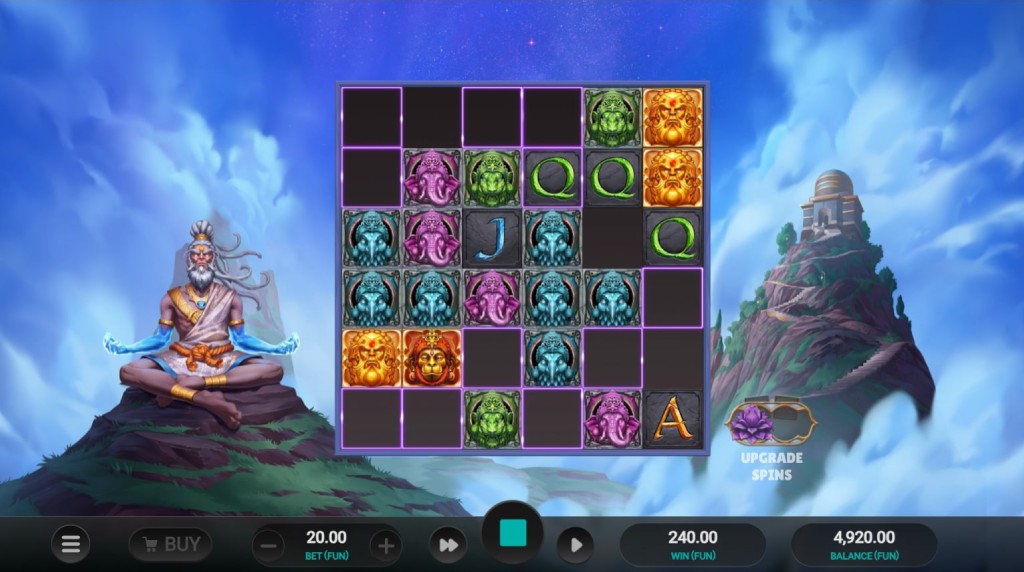

Aura God is a spiritual slot by Relax Gaming that takes its religious theme to...

Are you in the mood to play a lively slot with plenty of features? Thunderkick’s...

The BHA has announced a one-day strike during which no race meetings will take place...

Goodwood Racecourse and Virgin Bet announce a ‘presenting partner’ agreement that will debut at this...

3,151 kilometres, 46 mountain passes, 21 days of racing, 184 riders, one clear favourite. Will...

PokerStars, the world’s leading online poker room, has announced its schedule of live poker events...

One of Play’n GO’s many new online slots for 2025 is Spinnin’ Records Raving Reels....

Spreading wilds is one of the most exciting features about the newly announced ELK Studios...

One of many new slots to come online in 2025 is Dig It from Peter...

One of Pragmatic Play’s new online slots for 2025 is Fire Stampede 2. It’s a...

It’s the end of the road for greyhound racing at Birmingham’s Perry Barr Stadium, but...