| 1 |

Duelz |

5.0/5 |

Up to 140 Free Spins When You Deposit £25 |

Trustly, PayByMobile, Bank Transfer, Visa, Mastercard, PaysafeCard, Skrill, Neteller, PayPal

Play’n GO, NetEnt, Evolution, Pragmatic Play, Games Global, SG Scientific Games, Big Time Gaming, Blueprint Gaming, Red Tiger, Relax Gaming, Push Gaming, ELK Studios, Gamomat, Quickspin, Yggdrasil |

96.00% |

1 - 4 Days |

2600+ |

Claim Your Bonus! |

Read Review |

Full T&Cs apply. 18+. New players. Min deposit £25. Up to 140 Free Spins (20/day for 7 consecutive days on selected games). Manually claimed daily or expire at midnight with no rollover. Free spin value £0.10. Max winnings £100/day as bonus funds with 10x wagering requirement to be completed within 7 days. Game restrictions apply. Play Responsibly! GambleAware. |

| 2 |

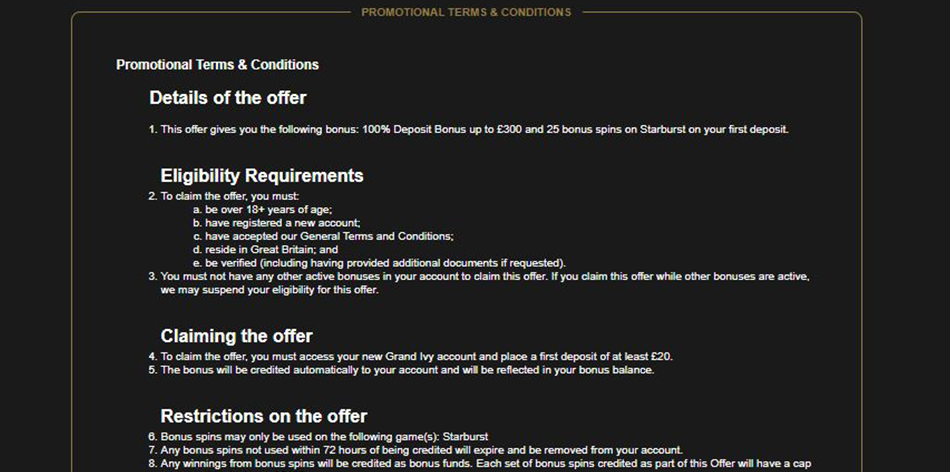

The Grand Ivy |

4.9/5 |

Bet & Get 75 Free Spins when betting £10 |

Visa, Mastercard, Bank Transfer, Skrill, Neteller, PaysafeCard

Pragmatic Play, Play'n GO, Red Tiger, Blueprint Gaming, Inspired, Wazdan, Relax Gaming, Scientific Games, Hacksaw Gaming, NetEnt, Microgaming, ELK Studios, NoLimit City, Evolution, Thunderkick, Merkur Gaming, IGT, Greentube, Iron Dog Studio, 1x2gaming, Spinomenal, Slingo, Synot, Just for the win, Lightning Box, Big Time Gaming, Switch, Leander, Gamevy, PG Soft, Spin Play Games, Net Gaming, All41 Studios, DWG, Eyecon, Realistic, Gold Coin Studios, Stakelogic, Push Gaming, Golden Rock Studios, Crazy Tooth Studio, Gameburger Studios, Spearhead Studios, Playzido, Triple Edge Studios, Northern Lights, Fantasma Games, Snowborn Games, Gaming Corps, Reelplay, RAW iGaming, Chance Interactive, Alchemy Studio, Kalamba Games, Stormcraft Studios, OnAir, Slingshot Studios, Prospect Gaming, Foxium, Endemol, Tom Horn Games, Authentic Gaming, Felt Gaming, Reel Time Gaming, Rabcat, Area Vegas, 4ThePlayer, Infinity Dragon Studios, Neon Valley Studios, Neko Games, S games, Nailed It Games, Pulse 8, Live 5 Gaming, Core Gaming, Pear Fiction Gaming, Fortune Factory, High Limit Studios, Oros, Four Leaf Gaming, Aurum Signature Studios, Red Rake Gaming, WMS, Buck Stakes Entertainment, Lucksome Studios, Revolver Gaming, Blue Guru Games, Wishbone Games, Armadillo Studios, Red7, Blue Ring Studios, Swintt, Spinmatic, Barcrest, Gacha Studios, Max Win, Old Skool Studios, Crucible Gaming, Ad Lunam, Hammertime Games, Lady Luck Games, Silverback, AGS, Gong Gaming Technologies, Storm Gaming, Spribe, Shuffle Master, Side City, Coin Machine Gaming, Rogue, Electric Elephant, Half Pixel Studios |

95.17% |

1 - 5 days |

2823 |

Claim Your Bonus! |

Read Review |

Full T&Cs Apply. 18+. New players only. Min. deposit £20. Welcome Offer is 75 free spins on Big Bass Bonanza on your first deposit. To claim the free spins you also need to wager a minimum of £10 of your first deposit on slots. Free spins must be used within 72 hours. Winnings from free spins credited as cash funds and capped at £100. These cash funds are immediately withdrawable. Affordability checks apply. Please gamble responsibly.GambleAware.org |

| 3 |

Casimba |

4.8/5 |

Bet & Get 50 Free Spins When Betting £10 |

Visa, Mastercard, Skrill, PaysafeCard, Neteller, Bank Transfer, Neosurf

Play’n GO, NetEnt, Evolution, Microgaming, Pragmatic Play, SG Scientific Games, Big Time Gaming, Blueprint Gaming, Red Tiger, Relax Gaming, Push Gaming, ELK Studios, Inspired Gaming, IGT, Hacksaw Gaming, Greentube, Eyecon, Octoplay, Realistic, Wazdan, Skywind Group, Stakelogic, SpinPlay Games, Synot, JustForTheWin, 1x2Gaming, Iron Dog Studio, Thunderkick, Reel Time Gaming, Fantasma Games, 4ThePlayer, AGS, Red Rake, Northern Lights Gaming, Snowborn Games, NoLimit City, Foxium, Lightning Box, Barcrest, Reel Play, Gameburger Studios, Spinomenal, Slingo, RAW iGaming, Felt Gaming, Rabcat, Neko Games, Fortune Factory, Wishbone Games, Red7, Spribe, Storm Gaming, Gong Gaming Technologies, All For One Studios, Tom Horn Gaming, Leander, Gaming Corps, Design Works Gaming, Area Vegas, Aurum Signature Studios, Buck Stakes Entertainment, Crazy Tooth Studio, Blue Guru Games, Blue Ring Studios, Alchemy Studio, Armadillo Studios, Authentic Gaming, Chance Interactive, Coin Machine Gaming, Core Gaming, Pear Fiction Gaming, Crucible Gaming, Ad Lunam, Hammertime Games, Lady Luck Games, Rogue, Electric Elephant, Half Pixel Studios High Limit Studios, Oros, Four Leaf Gaming, Slingshot Studios, Prospect Gaming, Endemol, Gold Coin Studios, Golden Rock Studios, Swintt, Spinmatic, Gacha Studios, Old Skool Studios, Spearhead Studios, Playzido, Triple Edge Studios, Neon Valley Studios, S games, Nailed It Games, Pulse 8, Live 5 Gaming, Max Win, Merkur Gaming, Lucksome Studios, Revolver Gaming, Kalamba Games, Stormcraft Studios, Switch, Gamevy, Infinity Dragon Studios, Side City, Net Gaming |

96.50% |

0 - 3 days |

3100+ |

Claim Your Bonus! |

Read Review |

Full T&Cs Apply. 18+. New players only. Min. deposit £20. Max. bonus bet is £5. Welcome Offer is 50 free spins on Big Bass Bonanza on your first deposit and 50% match up to £50 on your 2nd deposit. To claim the free spins you also need to wager a minimum of £10 of your first deposit on slots. Free spins must be used within 72 hours. Winnings from free spins credited as cash funds and capped at £100. These cash funds are immediately withdrawable. Bonus funds expire in 30 days, unused bonus funds will be removed. Bonus funds are separate to Cash funds, and are subject to 10x wagering the total bonus. Only bonus funds count towards wagering contribution. Affordability checks apply. Terms apply. Please gamble responsibly. GambleAware. |

| 4 |

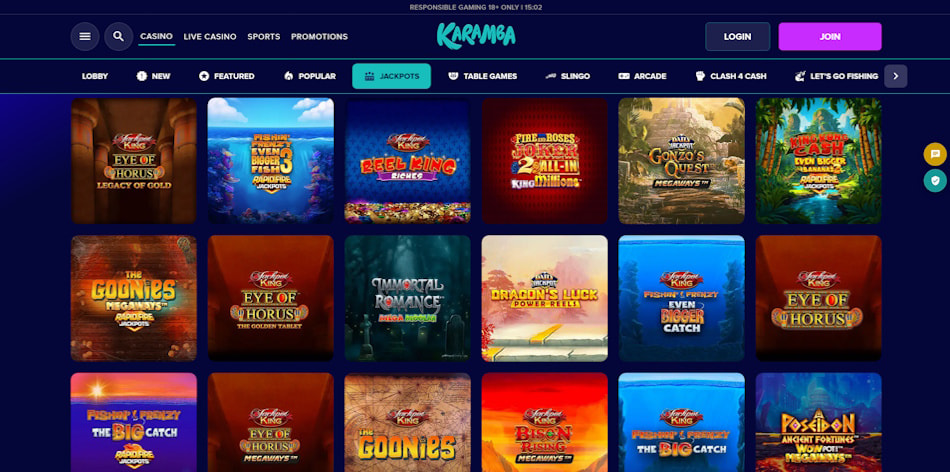

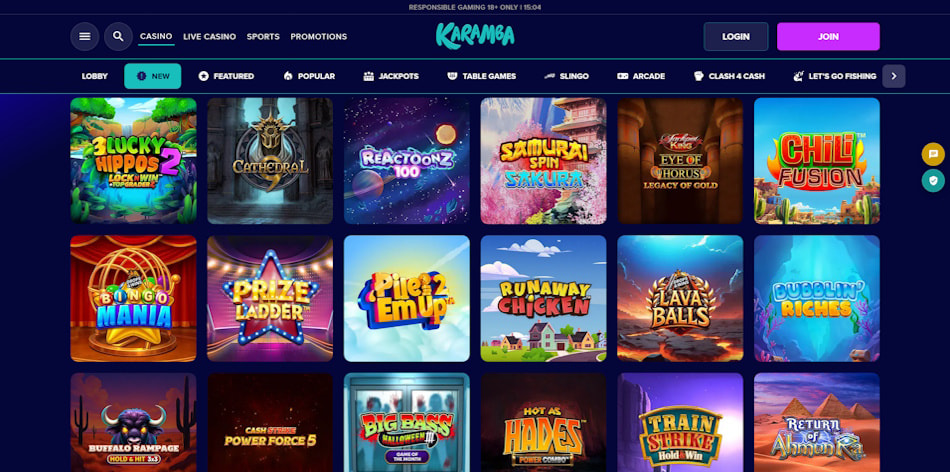

Karamba |

4.8/5 |

Get up to 300 Free Spins On Play'n GO games |

Visa, Mastercard, Bank Transfer, Trustly, PayPal, AstroPay, MuchBetter, Skrill, PaysafeCard

Pragmatic Play, NetEnt, Evolution, Play'n GO, iSoftBet, Ainsworth, Blueprint Gaming, Wizard Games, QuickSpin, Bally Wulff, Authentic Gaming, Red Rake, Red Tiger, Games Global, Skywind, StakeLogic, Playson, Eyecon, Gaming Realms, SYNOT Games, Ruby Play, Indigo Magic, 1x2gaming, Hacksaw Gaming, G Games, Spinomenal, Eyecon, Bluberi, Yggdrasil, Greentube, Atomic Slot Lab, NextGen, Scientific Games, SpinBerry, Booming Games, Betixon, Realistic Games |

96.00% |

1 - 6 days |

2600+ |

Claim Your Bonus! |

Read Review |

Full T&Cs Apply. 18+. New players only. Min dep £20. Offer is: 1st dep: dep & wager £20 within 7 days of registration to get 50 free spins. 2nd dep: dep & wager £20 within 7 days of your 1st dep to get 100 free spins. 3rd dep: dep & wager £20 within 7 days of your 2nd dep to get 150 free spins. Wagering is on Slot or Slingo games only. Spins valid on Play'n GO games. Winnings from Free Spins are credited as cash funds and capped at £100. These cash funds are immediately withdrawable. Free spins must be used within 7 days. Affordability checks apply. GambleAware.org. |

| 5 |

Griffon Casino |

4.7/5 |

Get up to 200 Free Spins |

Visa, Mastercard, Neteller, Skrill, Payz, AstroPay

Evolution Gaming, Blueprint Gaming, Eyecon, iSoftBet, NextGen Gaming, Play'n GO, Pragmatic Play, Red Rake, Red Tiger, Scientific Games, Skywind Group |

96.00% |

1 - 6 days |

2700+ |

Claim Your Bonus! |

Read Review |

Full T&Cs Apply. 18+. Welcome bonus: new UK depositing players only. 200 spins require 3 deposits of min. £20 each and are issued as follows: 50 on 1st deposit, 50 on 2nd deposit and 100 on 3rd deposit. Spins are issued on selected games. Winnings from spins are bonus with wagering requirements 35x. Spins expire after 24 hours. Bonus expires after 21 days. |

| 6 |

Ladbrokes |

4.7/5 |

Get 100 Free Spins When you play £10 on slots |

Apple Pay, Google Pay, Visa, Mastercard, Maestro, PayPal, PaysafeCard

Pragmatic Play, Play'n GO, Blueprint Gaming, Red Tiger, Playtech, Inspired Gaming, NetEnt, Light & Wonder, Yggdrasil, ELK Studios, IGT, Quickspin, iSoftBet, Hacksaw Gaming, Gaming Realms, Greentube, Eyecon, Octoplay, Realistic, Reel Kingdom, Rarestone Gaming, Relax Gaming, Wazdan, Wizard Games, Booming Games, Push Gaming, Skywind Group, Stakelogic, SpinPlay Games, Synot, JustForTheWin, Amatic Industries, Evolution, All For One Studios, 1x2Gaming, Iron Dog Studio, AGS, Spinberry, Thunderkick, Design Works Gaming, Ash Gaming, Reel Time Gaming, Fantasma Games, 4ThePlayer, Playson, Slot Factory, G.Games, Red Rake, Big Time Gaming, Northern Lights Gaming, Snowborn Games, NoLimit City, Foxium, Lightning Box, Barcrest, Reel Play, Gameburger Studios, NextGen |

96.11% |

1 - 5 days |

4300+ |

Claim Your Bonus! |

Read Review |

18+. New Casino players only. Deposit (certain types excluded) and Bet £10+ on Slots games to get 100 Free Spins (selected games, value £0.10 each, 48 hrs to accept, valid for 7 days). Restrictions and T&Cs apply. |

| 7 |

Coral |

4.6/5 |

Get 100 Free Spins When You Play £10 on Any Slot |

Apple Pay, Google Pay, Visa, Mastercard, Maestro, PayPal, PaysafeCard

Pragmatic Play, Play'n GO, Blueprint Gaming, Red Tiger, Playtech, Inspired Gaming, NetEnt, Light & Wonder, Yggdrasil, ELK Studios, IGT, Quickspin, iSoftBet, Hacksaw Gaming, Gaming Realms, Greentube, Eyecon, Octoplay, Realistic, Reel Kingdom, Rarestone Gaming, Relax Gaming, Wazdan, Wizard Games, Booming Games, Push Gaming, Skywind Group, Stakelogic, SpinPlay Games, Synot, JustForTheWin, Amatic Industries, Evolution, All For One Studios, 1x2Gaming, Iron Dog Studio, AGS, Spinberry, Thunderkick, Design Works Gaming, Ash Gaming, Reel Time Gaming, Fantasma Games, 4ThePlayer, Playson, Slot Factory, G.Games, Red Rake, Big Time Gaming, Northern Lights Gaming, Snowborn Games, NoLimit City, Foxium, Lightning Box, Barcrest, Reel Play, Gameburger Studios, NextGen |

96.27% |

1 - 4 days |

4000+ |

Claim Your Bonus! |

Read Review |

Full T&Cs Apply. 18+. New players only. Deposit (certain types excluded) and Bet £10+ on Slot games to get 100 Free Spins (selected games, value £0.10 each, 48 hrs to accept, valid for 7 days). Restrictions and T&Cs apply. |

| 8 |

Fitzdares |

4.6/5 |

100% up to £100 |

Visa, Mastercard, Maestro, Apple Pay, Bank Transfer

NetEnt, Blueprint Gaming, Microgaming, Evolution Gaming, Pragmatic Play, Realistic, Just For The Win, Inspired, Link2 Win, Skywind Group, Light & Wonder |

96.00% |

0 - 5 days |

2760+ |

Claim Your Bonus! |

Read Review |

Full T&Cs apply. New customers only aged 18+. Minimum deposit £10. Get a Casino Bonus matched to your first deposit, up to £100, after you stake £20 on slots, credited within 48 hours. Bonus expires in 7 days and has a 40x wagering requirement. Additional T&Cs apply. Please bet responsibly. |

| 9 |

Slotsrush |

4.5/5 |

Up to 50 Free Spins On 1st Deposit |

Visa, Mastercard, PayPal, MuchBetter, Bank Transfer, PayByMobile

NetEnt, 1x2Gaming, Alchemy Studio, All41 Studios, Area Vegas, Aurum Signature Studios, Buck Stakes Entertainment, Crazy Tooth Studio, Eyecon, Northern Lights Gaming, Snowborn Games, Foxium, Gameburger Studios, Pragmatic Play, Realistic, Just For The Win, Inspired, SpinPlay Games, Net Gaming, Gold Coin Studios, Hammertime Games, Infinity Dragon Studios, Neon Valley Studios, Neko Games, Nailed It Games, Iron Dog Studio, Live 5 Gaming, Pear Fiction Gaming, Play'n GO, Red Tiger, Prospect Gaming, RAW iGaming, Triple Edge Studios, Slingshot Studios, Switch, Wishbone Games, NYX |

96.37% |

1 - 7 days |

690+ |

Claim Your Bonus! |

Read Review |

T&C's apply. 18+. New customers only. First deposit only. 100% Bonus Match up to £100. Min deposit £10. Bonus can be used on Pragmatic Play slots only. Credited within 7 days. 40x wagering, £100 max conversion. Max one claim per player. |

| 10 |

Grosvenor |

4.5/5 |

Deposit £20, Play with £40 |

Visa, Mastercard, PayPal, PaysafeCard

NetEnt, Pragmatic Play, Play’n GO, NYX, IGT, WMS, Novomatic, Barcrest, Realistic |

97.15% |

1 - 3 days |

3185+ |

Claim Your Bonus! |

Read Review |

Full T&Cs Apply. 18+. New players only. Min Deposit £20, excl. PayPal & Paysafe. £20 bonus (x10 wager) on selected games. Max win £2K. T&Cs apply. GambleAware.org Play Responsibly. |