The Online-Casinos.com News in 2026

Welcome to the news hub of Online-Casinos.com. Here we cover all the latest developments concerning online gambling. Our news team will bring you current updates about legislation, casinos, sports, poker, as well as expert analysis and fun trivia from across the gambling industry.

Day 1 of the 2026 Cheltenham Festival features 112 races across seven races, with the Champion Hurdle being the headline contest. Key Facts: Cheltenham attracts 112 horses for its festival's opening day. Bookmaker odds suggest Irish-trained horses will claim 17 of the festival's 28 races. Willie Mullins is the clear...

The Big Bass series keeps on growing! The newest instalment is Big Bass Raceday Repeat,...

Gambling policy in the UK remains in a state of flux, with Ealing Council announcing...

Cryptoassets may be permitted to be used as a payment method at betting sites and...

Unlicensed companies could be prevented from signing sports team sponsorship deals in the UK. Key...

12 Pots of Gold Drum Frenzy is the latest of the new slots from Gameburger,...

King Kong Splash from Blueprint Gaming takes the King Kong character, places him in a...

Reelplay’s new slot game, Pearl Reef Gigablox Multimax, includes top features like the Gigablox symbols,...

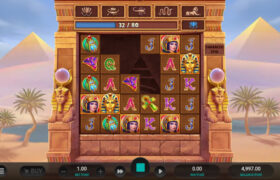

Pharaoh’s Last Wish is an online slot from Relax Gaming with medium volatility, an RTP...

UK online casinos are soon getting the latest of Stormcraft Studios’ new slots, Thunderstruck Stormblitz,...

Formula 1 is set to slip into gear starting with the release of Netflix docuseries...

A Cloudflare outage has caused a costly service disruption for bet365 and other UK-facing online...

One of Gaming Corps’s new online slots for 2026 is Whole Lotta Honey. Themed to...

Your 2026 Cheltenham Festival Betting Guide for Day 1 Races

Your 2026 Cheltenham Festival Betting Guide for Day 1 Races

Try the New Big Bass Raceday Repeat Slot on 9 March

Try the New Big Bass Raceday Repeat Slot on 9 March

Ealing Council Confirms New Policy Consultation on Gambling

Ealing Council Confirms New Policy Consultation on Gambling

UKGC: Cryptoassets Considered for Betting Site Payment Option

UKGC: Cryptoassets Considered for Betting Site Payment Option

Sports Sponsorship Deals Only for Licensed Gambling Companies

Sports Sponsorship Deals Only for Licensed Gambling Companies

Gameburger’s 12 Pots of Gold Drum Frenzy Set for Release

Gameburger’s 12 Pots of Gold Drum Frenzy Set for Release

Play Blueprint Gaming’s King Kong Splash Slot on 26 February

Play Blueprint Gaming’s King Kong Splash Slot on 26 February

Reelplay’s Pearl Reef Gigablox Multimax Coming to Online Casinos

Reelplay’s Pearl Reef Gigablox Multimax Coming to Online Casinos

Spin the Reels of the Pharaoh’s Last Wish Slot from Relax Gaming

Spin the Reels of the Pharaoh’s Last Wish Slot from Relax Gaming

Stormcraft Studios’ New Slot Thunderstruck Stormblitz Out Now

Stormcraft Studios’ New Slot Thunderstruck Stormblitz Out Now

F1 Is Back, Starting With Netflix’s Drive to Survive on Friday

F1 Is Back, Starting With Netflix’s Drive to Survive on Friday

Leading UK Betting Site Suffers From Costly Friday Downtime

Leading UK Betting Site Suffers From Costly Friday Downtime

Start Playing the Whole Lotta Honey Slot on 19 February

Start Playing the Whole Lotta Honey Slot on 19 February