Sportradar’s stellar year results in 31% year-on-year Q3 growth

Switzerland-based sports tech and media company Sportradar has reported steady growth and increased profits in its third quarter this year. Sportradar recorded a revenue spurt of 31% in Q3, with a year-on-date increase of 28% after accumulating a total of €178.8m in the same quarter. Their USA business’ year-on-year revenue saw a 61% increase and marked profitability for the first time in that segment.

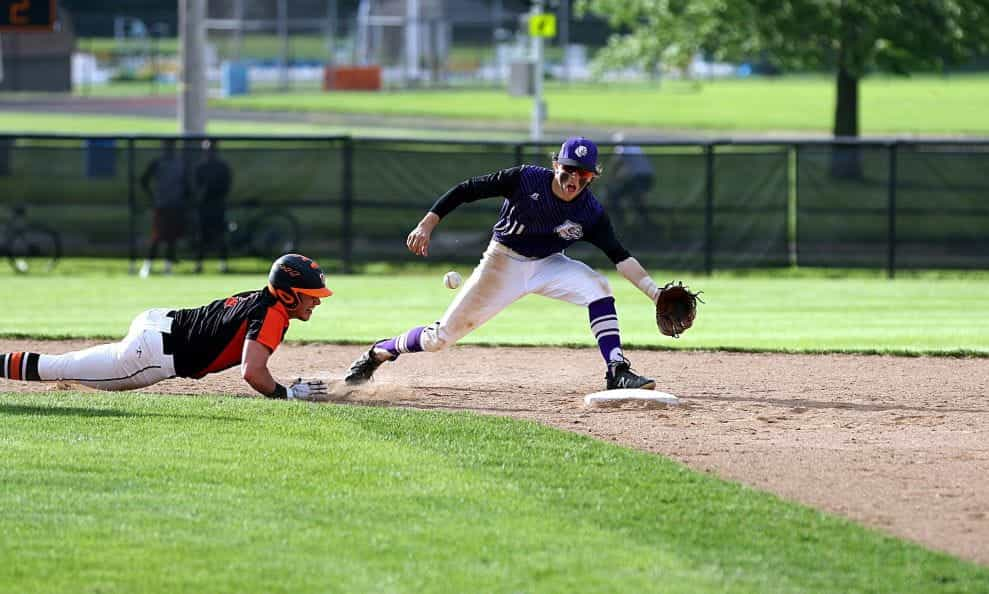

Sportradar has spread its coverage in the sports world as far as the Australian Baseball League so far this year. ©Chris Chow/Unsplash

Sportradar provides data and tech to over 1,700 sports federations, media outlets, betting operators and consumer platforms based in 120 different countries. The list is ever-growing as the sports technology company signed new deals with the National Hockey League (NHL), International Cricket Council (ICC) and Association of Tennis Professionals (ATP) last month. Apart from that, Sportradar is already the official data provider for the National Basketball Association (NBA), Major League Baseball (MLB), Union of European Football Associations (UEFA), among others.

Outside of working with sports authorities, in 2022, Sportradar also announced a tie-up with gambling operator Kindred Group. The two entities put pen to paper on a deal that sees Sportradar provide paid promotions on social media platforms in an effort to increase the rate of customer acquisition for the operator. Sportradar’s CEO, Carsten Koerl, said the company’s performance had exceeded expectations.

“Our strong performance in the third quarter exceeded our expectations across all key financial metrics. We consistently managed to grow revenue, profitability and cash flows despite adverse market conditions during the first three quarters of 2022. The Company exceeds expectations quarter-in and quarter-out, and as a result of our operational performance – in particular the U.S. and the betting rest-of-world business – as well as our organizational streamlining, we are able to raise our full year guidance for revenue and increase the lower end of our Adjusted EBITDA range.”

The key highlights in an impressive 2022

To put it mildly, 2022 has been a productive year for Sportradar so far – both in terms of client acquisitions and cash influx. The 31% year-on-year growth should not come as a big surprise considering the company’s activity in the market. A brief summary of their Q3 highlights speak to that:

- Q3 2022 revenue: €178.8 million

- Q3 2022 YoY growth: 31%

- RoW Betting segment revenue: €100.9 million

- RoW Betting segment growth: 28%

- U.S. Segment revenue: €31.6 million

- U.S. Segment growth: 61%

- Adjusted EBITDA revenue: €36.5 million

- Adjusted EBITDA growth: 75%

The most recent marquee deals

In October, Sportradar closed on a long-term partnership with the FanDuel Group for official NBA data. Their partnership with the NBA means they will be FanDuel’s exclusive provider of NBA, WNBA and NBA G League Data until the 2030-31 season. Apart from the provision of NBA data, supplementary betting services will also be provided to boost the overall performance of the sportsbook.

To follow that, Sportradar also announced earlier in November that they had partnered with Baseball Australia (BA) to broadcast the Australian Baseball League on a brand new OTT platform. The deal also made Sportradar the exclusive betting data and audiovisual rights distribution partner for the league, alongside making them the official integrity partner of the league as well. This means that Sportradar’s Universal Fraud Detection System (UFDS), which has now become the gold standard for corruption monitoring in sports, will be involved.

Dave Edwards, Sportradar’s Director of Sports Media and Partnerships for the Oceania region, said the deal would be particularly important for content distribution.

“We’re pleased to partner with Baseball Australia and the ABL to help them reach and engage new audiences both here in Australia and around the world. By taking an intelligent, technology-driven partnership approach to content distribution, rights holders can directly control how their assets are commercialised, while learning more about their fans in the process. We look forward to assisting BA and the ABL as they pursue their ambitious growth strategy.”